can you look up a tax exempt certificate

The purchaser can give a single purchase certificate for just one transaction or a blanket certificate that applies to future purchases of qualifying exempt items. Form 990 Series Returns.

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

Sales and Use Tax Certificate Verification Application.

. If the item is tax exempt under a specific exemption based on its usage and is not for resale the purchaser should give the seller an exemption certificate. Form 990-N e-Postcard Pub. An IRS agent will look up an entitys status for you if.

Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

There are different types of exempt. Sales Tax Exemption Certificates for Governmental Entities. For questions or assistance please contact DOR Customer Service Bureau at 608 266-2776 or.

Sellers should exclude from taxable sales price the transactions for which they have accepted an exemption certificate from a purchaser as described below. Paul MN 55146 Phone. Sales and use tax.

The Minnesota Department of. However we recommend updating exemption certificates every three to four years. Do not send this form to the Department of Revenue DOR.

A valid certificate taken without fraudulent intent will pass the tax burden for unreported sales tax from the seller directly to the purchaser. 13 rows If you intend to use the supplies yourself you cannot use a resale exemption certificate. On the Certificates screen tap Manage Certificates.

Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. If audited the seller will use exemption certificates to support tax exempt sales. Resale Exemption Certificates Marketplace.

Exemption certificates do not expire unless the information on the certificate changes. The following documents must be submitted with your application or it will be returned. In the Business Wallet section select Tax Exempt Certificates.

If you cannot find the one you are searching for try entering a more specific name. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase.

Tax-deductible contributions may be made to an organization whose tax-exempt status is subsequently reinstated and that is listed in this Tax Exempt Organization Search as being eligible to receive tax-deductible contributions. Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each local chapter. CustomCat is legally required to collect sales tax on goods purchased in certain US states unless documentation is submitted indicating our transactions with your business are exempt from taxationBelow you will find a step-by-step guide for using our Tax Wizard to submit the 2 most common types of exemption certificates.

Different purchasers may be granted exemptions under a states statutes. You can find out if the exemption status has been reinstated by reviewing the Pub. Tax Policy and Statistical Reports.

You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office. Tax Exempt Organization Search Tool.

Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax. Exemption certificate instructions can be found here. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers.

Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item or because the customers are making a purchase for a non-profit organization an individual or a business possessing a valid Tennessee certificate of exemption. The revocation posting date is different from the revocation date displayed on the results page. Oklahoma Go to this page at the Oklahoma Tax Commission site and click Permit Look-up System Call 405-521-3160 option 2 and enter the permit number.

You will be given REV-1220 Pennsylvania Exemption Certificate before you invoice otherwise you are required to charge them sales tax. 78 Data for 501c3 organizations or reviewing its determination letter which would show an effective date on or after the automatic revocation date with the online tool or the bulk data download files. Automatic Revocation of Exemption List.

Please see the Suggested Format for an Exemption Certificate Based on Propertys Use Form DR-97. Here youll be able to view. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

Use the form below to verify that the customer possesses a valid tax exempt number or. Exemptions are based on the customer making the purchase and always require documentation. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Only organizations exempt under 501 c. The exemption certificate must be complete An exemption certificate must be thoroughly completed by the purchaser to. Sellers must retain copies of the exemption certificates.

Active The AgricultureTimber registrant has an active agriculturetimber registration number and is eligible to issue an agtimber exemption certificate to their suppliers to. Pennsylvania Online verification is not available. You may also review the EO BMF Extract to check the organizations current exempt status.

Form ST16 Application for Nonprofit Exempt Status-Sales Tax. Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the certificate or a printed and signed copy. Florida law grants governmental entities including states counties municipalities and political subdivisions eg school districts or municipal libraries an exemption from Florida sales and use tax.

You can also search for information about an organizations tax-exempt status and filings. Revenue Minnesota Department of. Open the Menards app and sign in with your MENARDSCOM account login info.

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

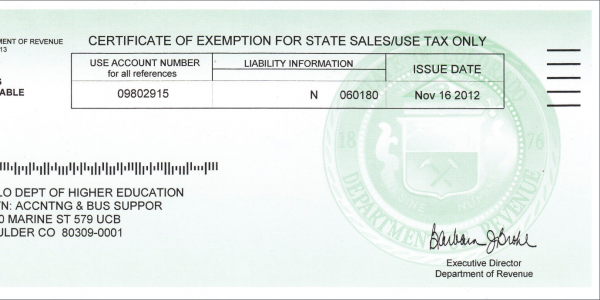

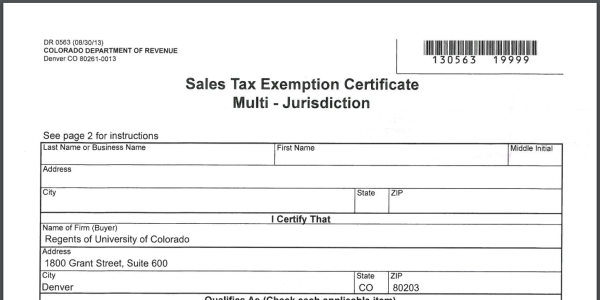

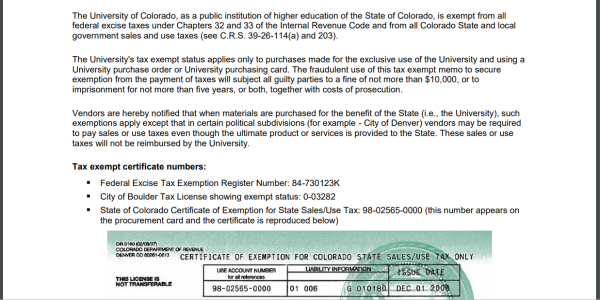

Sales Tax Campus Controller S Office University Of Colorado Boulder

Free 10 Sample Tax Exemption Forms In Pdf

Sales Tax Campus Controller S Office University Of Colorado Boulder

Free 10 Sample Tax Exemption Forms In Pdf

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Sales Tax Campus Controller S Office University Of Colorado Boulder

Resale Certificate Request Letter Template 7 Templates Example Templates Example Letter Templates California Constitution Free Certificate Templates

How To Get Student Council Tax Exemption Save The Student

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

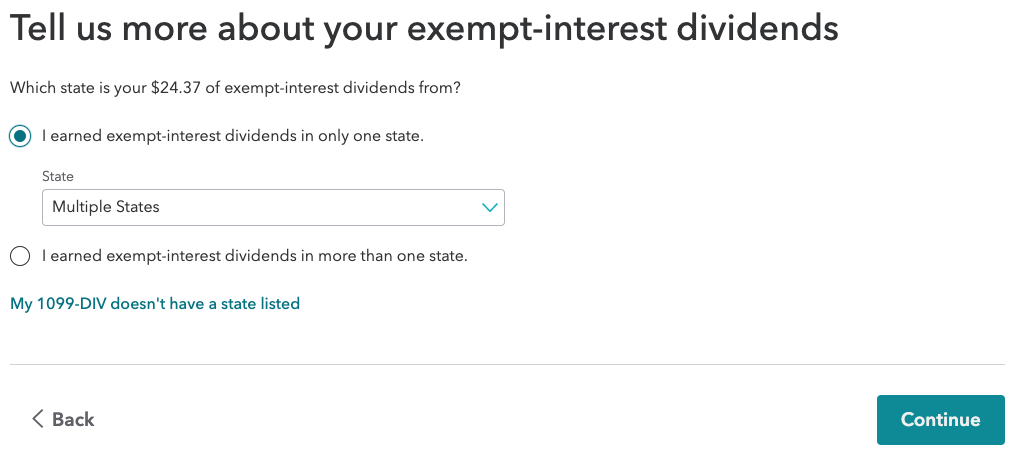

How Do I Address Exempt Interest Dividends In My Tax Return Or Tax Software Wealthfront Support

Free 10 Sample Tax Exemption Forms In Pdf

Interest Income Form 1099 Int What Is It Do You Need It

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller